Money does not buy happiness, but it sure brings you closer to happiness. More importantly, it frees up time so that you can do things that make you happy.

Why Equities?

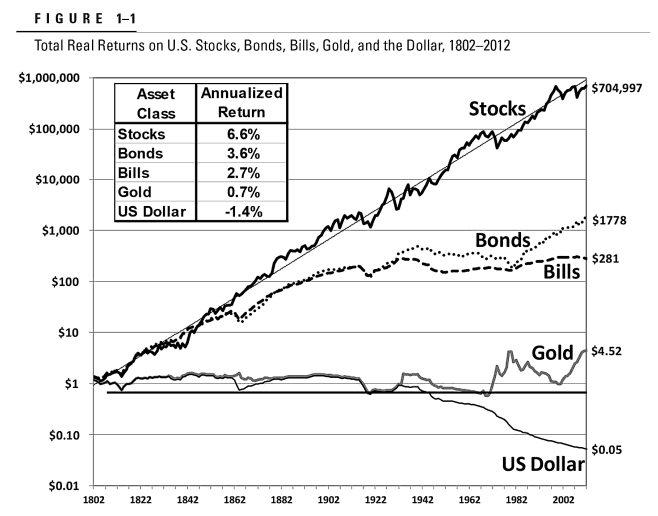

Other than winning a lottery ticket, the only way to make the money you earned grow is by investing. Investing comes in different forms, entrepreneurship, equities, bonds, metal, savings accounts etc. You have many choices. The chart below clearly shows which one is the better one long term

Some principles

Compounding : When people think about compounding they think about compound interest, but compounding is a lot more than interest on money. We as humans are wired to make our lives better. While at an individual level, some of us might fail, we have made tremendous progress as humanity. Imagine the effort you put in to better your life.. now multiply that by every person, city, company and country in the world. Let the world work for you in equities.

Stay in the game : There is nothing in this world that is risk free. But you also have to make sure you are not taking undue risk. This quote from Warren Buffet captures this principle “Rational people don’t risk what they have and need for what they don’t have and don’t need”. To keep it simple, don’t make any new investments more at more than 10% of your portfolio.

A simple portfolio

40% allocation to US Large Caps. : https://investor.vanguard.com/etf/profile/VV

30% allocation to International Stock Market : https://investor.vanguard.com/etf/profile/VXUS

20% allocation to to US Growth Companies : https://investor.vanguard.com/etf/profile/VUG

10% allocation to other investments. Remember the principle to never invest more than 10% of your portfolio in one single investment.

PS : This is not advice nor am I an certified financial advisor. Your money, your risk, your reward 🙂